Multifamily Investments in a U.S. Gateway Market: San Francisco Bay Area

Ron E. Cruz

Published Online: 24 November 2020

Abstract

Multi-unit residential in U.S. Gateway Markets are favored investments. Well located multifamily property has the potential to hold its value better than other markets. Primary markets like the San Francisco Bay Area are blighted with the rent control, suppressing aggressive rental increases, and lowering immediate investment returns. Despite this complexity, capital from institutional investors such as real estate investment trusts (REITs), pension funds, and private equity still flow to this market, further increasing the already inflated value of property. The sentiment of favoritism on real estate investment in this market is centered around strong employment, prestige, and scarcity.

Slide 2/50 via Presentation

Slide 8/50 via Presentation

Introduction

Slide 12/50 via Presentation

Real estate is regarded as an investment vehicle that allows for further diversification within the traditional portfolio that primarily consists of stocks and bonds. Adding real estate to one’s investment portfolio allow for multiple advantages that range from residual cash flow, varying tax advantages, appreciation, and increased equity through mortgage pay down. Investment property asset classes come in a wide array, ranging from office, industrial, retail, and multifamily.

Multi-unit residential or multifamily properties are regarded as foundational investments in real estate portfolios. Since multifamily assets are a major portfolio allocation within the real estate capital markets, there is much debate as to where properties should be located. My research will be seeking to expand on why capital still flows to multifamily investment property in the San Francisco Bay Area market despite the complications of a high price premium and strict policies against aggressive rental increases.

Slide 14 / 50 via Presentation

The primary driver for values in real estate aside from specific asset class distribution is its location. Property located in rural markets tend to have lower values, allowing for a larger pool of buyers. Despite the vast availability of buyers, real estate values are also driven by the spatial demand of individuals, businesses, and opportunity relative to the marketplace. Areas with greater income earning potential and larger populations tend to have higher property values across all real estate asset classes. U.S. Gateway markets tend to have some of the highest property values, creating a dynamic that prevents most investors from entering the market and extremely compression in regard to investment returns. Despite these challenges, investment capital is still deployed netting attractive returns.

Multifamily investments in other markets pose certain risks and ramifications that are not as evident in a U.S. Gateway market such as the San Francisco Bay Area. In other words, investments in Non-U.S. Gateway markets can see higher returns for investors, but not without significant risk. As a result, the risk premium available for investors who seek to be more aggressive may not coincide with the investment strategy of those looking for consistency. Investors that are seeking safer investments, especially in turbulent markets, are willing to sacrifice aggressive returns to drastically reduce their risk exposure.

Slide 24/50 via Presentation

Many U.S. Gateway markets come with the varying complications of tenant friendly rulings such as rent control, vacancy control, or rent stabilization. Rent control in California has hindered investment capital from flowing into the market due to the inability to aggressively increase rents thus suppressing investment yield. To accommodate for challenge, investors must find new strategies to increase their yield. Investors who purchase multifamily in major markets generally are seeking the attractiveness of renters and businesses who demand proximity to centralized business districts and major areas of import or export. The demand for space and commerce within centralized business districts has historically increased in value over the long term, providing growth and foundational value to adjacent multifamily property. The marginal benefits to investment capital deployment within the San Francisco Bay Area market is primarily derived from scarcity, value appreciation, and redevelopment opportunities.

Through the utilization of various academic journals, multifamily brokerage research cohorts, and trade organizations, data was procured to support different conclusions on multifamily investment in the Bay Area. Prior research from these sources were able to analyze statistics and varying value metrics to show San Francisco Bay Area multifamily property possessing more stable returns on capital. These value metrics support the claim that San Francisco Bay Area multifamily despite the premium, can still be an investment alternative that can withstand global market volatility.

Multi-unit residential investment properties in a U.S. Gateway market such as the San Francisco Bay Area historically have subpar base investment yields in comparison to secondary and tertiary markets. Though the investment return from U.S. Gateway market properties as opposed to other market alternatives may be low, properties located in these primary markets have significantly lower volatility. Experienced owners and operators are still able to navigate the varying complications, allowing them to create value-add opportunities that smaller-scale investors are unable to utilize.

Existing Literature

To understand how and why capital flows to multifamily properties in U.S. Gateway markets, we need to first understand the metrics, methods, and drivers used to determine and establish value. Understanding the value determinants allow us to further expand on research found on the drivers of multifamily investment in the San Francisco Bay Area. The location in our research has the complexity of rent control rulings that often impede and discourage investment capital from freely flowing in.

Slide 17/50 via Presentation

Multifamily and other commercial investment properties’ values are denoted by the capitalization rate, often abbreviated as “cap rate” (Li, J. et. al, 2020). The cap rate, expressed as a percentage, is derived by dividing the net operating income (NOI) of the property by the estimated value. By utilizing the simplicity of the cap-rate valuation method, we are able to compare real estate investment properties to investment alternatives such as Treasury bills, bonds, equities, and mortgage security yields (Li, J. et al, 2020). Stocks and exchange traded funds (ETFs) tend to have higher yields but are riskier than lower return alternatives such as the U.S. Treasury bill. Similarly, an investment property with a low cap rate is generally regarded as a safer, stabilized investment, and high cap rate properties are associated with additional risks and challenges.

Slide 20/50 via Presentation

Gateway market cities serve as popular locations for real estate investment due to the quality, size, and stability properties available (Devaney, S. et. al, 2019). Investment into Gateway markets is often motivated by stringent laws in a home market or fewer overall opportunities for investment (Devaney, S. et. al, 2019). A study conducted in over 38 U.S. metropolitan statistical area (MSA) markets found that foreign investment into Gateway markets corresponded to an over 80 basis point reduction in overall market cap rates (Devaney, S. et. al, 2019). The drastic reduction in cap rap rates provide insight to investor sentiments of security within U.S. Gateway markets. As the capitalization rate compresses, the value of the property increases, but the return on investment annually gets suppressed. Utilizing a case study example, in the event a property’s capitalization rate of 5% spikes up by 100 basis points to 6%, the asset drops 17% in value (Geltner, D. et. al 2017). In that same example, a property’s cap rate decreasing by 100 basis points can equate to an increase in the property’s value by 17%. With the cap rate being an extremely sensitive measure to value, we can approach the pricings of property with a stronger, more analytical approach. Properties that have higher cap rates are denoted as opportunistic and more volatile, while properties with low cap rates are coined as stabilized and more risk averse.

Stabilized properties are generally acquired as a way to protect capital and to hedge aggressive portfolio investments (Geltner, D. et. al 2017). Stabilized assets generally do not have additional room to aggressively appreciate in value. Investment firms and funds often disregard aggressive, opportunistic real estate investments, preferring that of consistent growth through uncertain market cycles (Devaney, S. et. al, 2019). The premium on stabilized investment properties create a participation barrier making it difficult for investors with less capital to hit hurdle rate minimums for their debt and equity investors. Well-funded investment firms are able to capitalize on the reduced competition for stabilized assets by utilizing professional asset management or redevelopment opportunities to further squeeze yield from stabilized properties.

Slide 27/50 via Presentation

One of the foundational valuations to real estate is its location. If a property is in a tertiary market, it will not hold as much value as something that would be in a location with a higher population and household income. With U.S. Gateway MSAs being more well- documented and transparent with sales and asset information, well-capitalized investors are able to exploit this, strategically entering and exiting real estate investments as well as maximizing their return (Ling, D.C. et. al, 2019). Secondary and tertiary markets tend to have less sales and leasing activity, making valuation of properties opaquer. When an investment objective is to reduce risk while maximizing yield, having assets with obscure valuations can drastically increase portfolio beta. Assets located in U.S. Gateway markets provide investors with significantly reduced ambiguity, allowing for predictable investment return. With the various MSA options available for investments, the individual MSA risk exposures are determined to be a key driving factor for investment funds and fund managers (Li, J. et. al, 2020). Studies completed across 3,000 transactions in New York City revealed that foreign investors paid a significant premium than their domestic counterparts. The trends revealed from the study showed investment being concentrated on newer and larger stabilized properties (Devaney, S. et. al, 2019). Properties that are stabilized have predictable return metrics that investment managers can forecast, allowing them to be confident with their decisions.

Slide 28/50 via Presentation

Multi-unit residential properties in U.S. Gateway markets like the San Francisco Bay Area benefit from strong economic growth components. Investors such as Real Estate Investment Trust (REIT) managers, pension funds, and sovereign wealth funds have an obligation to invest in real estate with strong fundamentals. (Ling, D.C. et. al, 2019). Areas such as San Francisco are favorites for investors with a defensive investment strategy requirement as they are in proximity to multiple drivers of values. These include San Francisco’s abundance in high paying tech corporations that employ talent internationally and the abundance of venture capital, private equity, and angel investment firms. With strong fundamental drivers of values, investments in this market tend to be of higher quality to those in other locations. This creates an environment that entices international investment cohorts to enter the market, seeking safety from market volatility and to hedge riskier assets in an investment portfolio. (Devaney, S. et. al, 2019). Investors deploy capital to markets such as the San Francisco Bay Area to defend their capital and benefit from fundamental economic drivers of wealth. With set hurdle rates and mandatory return metrics to satisfy, these investors prefer predictable assets with lower beta values.

A major investment handicap found in a U.S. Gateway markets like San Francisco are the tenant friendly laws and policies. A major tenant friendly law ubiquitous within U.S. Gateway markets is rent control. Rent control limits a landlord’s ability to evict a tenant and sets strict guidelines to the amount rents can be increased. This ruling creates a dynamic where landlords prefer short-staying tenants than long-term tenants as this allows the landlord to constantly readjust rents to market rates with ease. (Basu, K. et. al, 2000). In San Francisco, landlords are incentivized to remove long term tenants under the jurisdiction on rent control given the extreme delta found between fair market rents and rents suppressed by rent control. (Diamond, R. et. al, 2019) The repositioning strategy to increase value through the removal of long-term tenants requires investors to be well capitalized to deal with the legal and public ramifications from evicting tenants. Smaller investors who own rent controlled multifamily properties are unable to capitalize on the varying methods to increase their return in a market that has rent control. Newer multifamily products or redeveloped buildings are exempt from rent control, allowing for significant upside in older properties where maintenance has been deferred. (Diamond, R. et. al, 2019) The challenge of rent control adds to the premium, restricting investors with less capital from reaping the benefits from repositioning rent-controlled buildings.

Slide 29/50 via Presentation

Properties in U.S. Gateway markets are able to command a high price due to the strong economic foundational drivers. Multifamily investments in markets such as the San Francisco Bay Area tend to have lower capitalization rates, coinciding with the narrative that investing in these properties pose lower risk. The lower cap rates also indicate that these assets tend to be stabilized with limited options to drastically change in value. The complication of rent control in the Bay Area hinder those less capitalized seeking to compete in the pursuit of multifamily investment opportunities.

Analysis from Empirical Data

The evidence, research, and data from various sources deduce strong implications in regard to property in U.S. Gateway markets are generally turn-key investments that still have additional room for value for well capitalized investors.

Slide 33/50 via Presentation

The economic growth drivers of labor and entrepreneurship serve as foundational metrics to high values of real estate within US Gateway markets. The San Francisco Bay Area contains four of the five prominent American tech companies that make up the ubiquitous acronym FAANG (Facebook, Amazon, Apple, Netflix, Google). With the exception of Amazon, Facebook, Apple, Netflix, and Google all have their corporate headquarters based here and are regarded for their generous compensation packages provided for their employees. These large employers recruit and retain talent internationally, adding to the prestigious reputation the Bay Area holds. Silicon Valley, located along the peninsula of the Bay Area, also serves as the home for what is considered the mecca of venture capital – Sand Hill Road. Venture capital is classified as a private equity variant that finances startups and small businesses with high growth potential. Venture investors and associates are opportunistic with their funds and are considered the pinnacle of private wealth. With an abundance of tech firms and venture capital, the Bay Area’s is regarded as a formidable U.S. Gateway market for innovation and thought. Investment management and services company Colliers International released a market report on the Peninsula, Silicon Valley, and San Francisco showing the median household incomes (HHI) within these sub-markets being around $120,000 and rising. With highly regarded employers driving average HHI upwards and the constant recruitment of international talent, residential property values skyrocket due to constant demand to house skilled workers.

The multifamily investment climate within the San Francisco Bay Area command high rents which equate to high property values even during turbulent market conditions. Summer 2020 research conducted by Yardi Voyager, an international cloud-based property management and accounting platform, found Bay Area rents and prices per unit contracting in the wake of the coronavirus pandemic. Despite the contraction, Bay Area’s rent still stands strong at roughly $2,588 which is over 1.5 times the U.S. national average of $1,465. The average price per unit in the Bay Area according to this same report has contracted from $436,142 to $387,519 from Spring to Summer which also notably over the U.S. average. High prices per unit create a dynamic for Bay Area properties to be valued considerably higher than the national average.

Given these metrics, we can illustrate the price deviation between a generic 40-unit apartment located in a standard market to that of the Bay Area. In most markets, the 40-unit would be valued at $6,000,000 based on a $150,000 per unit national average valuation supported by Yardi and commercial real estate firm Cushman and Wakefield. Utilizing the summer $387,000 per unit valuation, Its Bay Area counterpart is priced at over $15,500,000. With a delta of $9,000,000, property in the Bay Area are priced significantly higher, making investment. We can further expand on this by utilizing the cap rate metric to see a spread between national and major market values. Based on research conducted by the commercial brokerage firm Newmark Group’s Multifamily Capital Markets division, cap rates in a major market like San Francisco gravitate to be 4.7% or less, whereas its non-major market being 5.6% or higher. This 90-basis point spread is only part of the narrative on cap rate compression and value distortion. As we have learned from the research section, assets generally have higher cap rates in proportion to their risk profile, while a lower cap rate indicate an asset less prone to volatility and market disorder.

Slide 36/50 via Presentation

Aside from the high prices and low cap rates, participation in San Francisco Bay Area real estate investment is faced with stringent tenant friendly rulings. The complication of rent control creates an environment where many smaller investors are unable to obtain adequate investment returns. These smaller property owners are both less incentivized and unable to consistently upkeep their properties and provide amenities for their inhabitants. The lack of free working capital slowly pushes property towards statuses of deferred maintenance, creating uncomfortable living conditions for their residents. These smaller investors are eventually placed in a position where they are losing money from owning the property, putting them into a position where they must sell to an investor with greater funding capabilities to prevent further losses. The new owner then generally executes repositioning strategies such as the revitalizing and upgrading the building to cater to tenants who are able to cover the debt and expense obligations of property ownership.

Slide 37/50 via Presentation

Well-funded investors in the San Francisco Bay Area market are able to leverage their capital in a tight market like the Bay Area through the redevelopment of existing rental properties that have underperforming rents due to rent control. Higher-end housing in this market has historically attracted residents that have near 20% higher income than their rental suppressed counterparts in the same zip code. (Diamond, R. et. al, 2019) The redevelopment of units that were formerly under the jurisdiction of rent control create upward pressure on lower rent properties as they become scarcer. With an incontestable supply and demand imbalance, a popular market like the Bay Area only further caters to the well-funded, providing excellent investment returns from repositioning strategies. Ironically, the strict tenant friendly policies do the opposite of what they were intended to originally do, by discouraging the maintenance and upkeep of multifamily properties that have suppressed rents due to rent control rulings. There is a consistent exchange of properties from the smaller investor to the wealthier, as only those with an abundance in working capital are able to benefit from investment opportunity here.

Slide 45/50 via Presentation

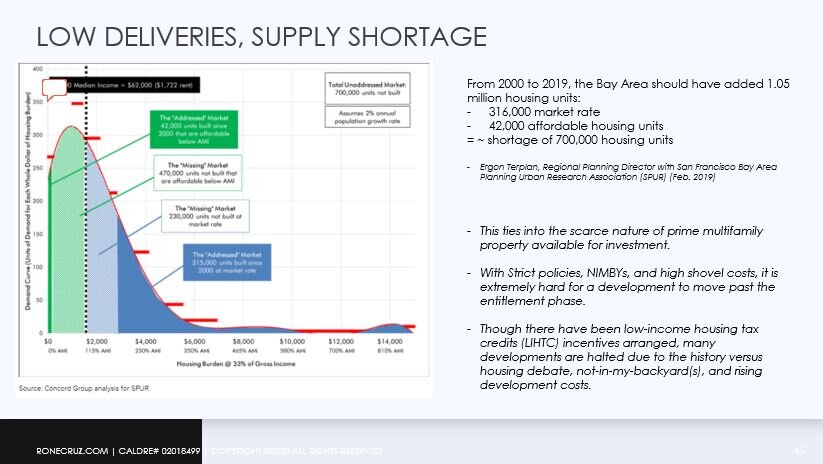

With only heavily funded investment individuals and cohorts being able to participate in redevelopment or the repositioning of assets in this market, there is an extreme dearth in new multifamily product that provides for lower income renters. The slow trickle of new apartment buildings applies upward pressure to the existing rental stock, driving rental rates higher due to the unavailability of residential rental product for consumers.

The disconnect between available affordable and market rent units create a dynamic where apartments under the jurisdiction of rent control, though possessing lower than market rates, also see a premium. Rent controlled units, similar to their market rent counterparts, are in high demand from lower income renters that are willing to pay for space based on the drivers of employment opportunity proximity and generational residence. The subsidized units often have blatant issues of deferred maintenance and are situated in lower-income neighborhoods.

Until the supply problem is solved, demand side measures will not be fulfilled, creating an escalation in value for scarce property. This is an ongoing challenge as the population and wages increase within the Bay Area with the supply of residential housing units lagging far behind the demand.

Concluding Remarks

Slide 47/50 via Presentation

Through our research, we found that there is a premium on multi-unit residential properties in U.S. Gateway markets and that capital being deployed to these markets are fundamentally driven by economic drivers of labor and proximity. At first glance, the high price point is a major deterrence for investors seeking property in these markets. However, with significantly lower volatility than most MSAs as depicted by the compressed capitalization rates, property in the San Francisco Bay Area retain high equity values during turbulent times.

Many U.S. Gateway markets have additional complications to their price premium such as rent control. Though rent control creates an environment that is difficult for the average investor to obtain yield, investment capital still flows abundantly from investors flush with capital due to the innate opportunity of repositioning and redeveloping extremely well-located real estate. The select few who are able to execute these strategies see immediate upside on their investment upon asset delivery to market, providing a high-end experience and amenities to their residents.

Though this research has allowed for a holistic view of multifamily investment motivations in the San Francisco Bay Area, each property prior to acquisition or disposition require an in-depth analysis and underwriting to determine a proper hold and exit strategy. While there are many factors that attribute to the stability of real estate investment within U.S. Gateway markets, more research is needed to determine underlying factors for investment decisions and motivations in the globalized investment property market.

Slide 50/50 via Presentation

References

Basu, K., & Emerson, P. (2000). The Economics of Tenancy Rent Control. The Economic Journal, 110(466), 939-962. Retrieved November 3, 2020, from http://www.jstor.org/stable/2667859

Bates, L.J., Giaccotto, C. & Santerre, (2015) R.E. Is the Real Estate Sector More Responsive to Economy-Wide or Housing Market Conditions? An Exploratory Analysis. J Real Estate Finan Econ 51, 541–554. https://doi-org.libaccess.sjlibrary.org/10.1007/s11146-014-9491- y

Devaney, S., Scofield, D. & Zhang, F. Only the Best? (2019) Exploring Cross-Border Investor Preferences in US Gateway Cities. J Real Estate Finan Econ 59, 490–513. https://doi- org.libaccess.sjlibrary.org/10.1007/s11146-018-9690-z

Diamond, Rebecca, Tim McQuade, and Franklin Qian (2019) "The Effects of Rent Control Expansion on Tenants, Landlords, and Inequality: Evidence from San

Francisco." American Economic Review, 109 (9): 3365-94. https://www-aeaweb- org.libaccess.sjlibrary.org/articles?id=10.1257/aer.20181289

Gagiuc, A. (2020). San Francisco Multifamily Report – Summer 2020. Retrieved October 27, 2020, from https://www.multihousingnews.com/post/san-francisco-multifamily-report- summer-2020/

Geltner, David M. and Alex van de Minne. “Do Different Price Points Exhibit Different Investment Risk and Return in Commercial Real Estate?” The Journal of Portfolio Management 43, 6 (September 2017): 105–119 © 2017 Institutional Investor, LLC

Garcia, K. (2020). US Multifamily MarketBeat: United States. Retrieved October 07, 2020, from https://www.cushmanwakefield.com/en/united-states/insights/us-marketbeats/us- multifamily-marketbeat

Li, J., Liang, X. (2020) Beyond the Cap Rate: Valuation of Multifamily Properties. J Real Estate Finan Econ 60, 99–110. https://doi-org.libaccess.sjlibrary.org/10.1007/s11146-019-09717-9

Ling, D. C., Naranjo, A., & Scheick, B. (2019). Asset Location, Timing Ability and the Cross‐ Section of Commercial Real Estate Returns. Real Estate Economics, 47(1), 263–313. https://doi-org.libaccess.sjlibrary.org/10.1111/1540-6229.12250

Mazur, J., & Wolfson, M. (2020). United States Multifamily Capital Markets Report. Retrieved November 01, 2020, from https://www.ngkf.com/insights/market-report/united-states- multifamily-capital

Shanahan, B., & Garcia, D. (2020). 2020 Fall NorCal Multifamily Market Research Report: Colliers International. Retrieved November 01, 2020, from https://www2.colliers.com/en/Research/Sacramento/2020-Fall-NorCal-Multifamily- Market-Research-Report